Small Business Accounting Service In Vancouver Can Be Fun For Anyone

Wiki Article

The Small Business Accountant Vancouver Ideas

Table of ContentsHow Tax Accountant In Vancouver, Bc can Save You Time, Stress, and Money.The Buzz on Pivot Advantage Accounting And Advisory Inc. In VancouverThe 4-Minute Rule for Vancouver Tax Accounting CompanyNot known Facts About Pivot Advantage Accounting And Advisory Inc. In VancouverFascination About Small Business Accounting Service In VancouverIndicators on Virtual Cfo In Vancouver You Need To Know

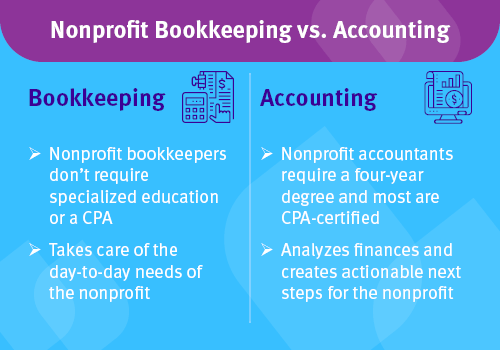

Right here are some benefits to working with an accounting professional over a bookkeeper: An accounting professional can offer you a detailed view of your company's economic state, along with techniques as well as suggestions for making financial choices. Bookkeepers are just accountable for recording monetary transactions. Accountants are required to complete more schooling, certifications and also work experience than bookkeepers.

It can be challenging to gauge the proper time to hire an accounting expert or bookkeeper or to identify if you require one in all. While numerous local business hire an accountant as a professional, you have a number of alternatives for handling economic tasks. Some tiny business proprietors do their very own accounting on software their accountant recommends or uses, providing it to the accounting professional on a weekly, month-to-month or quarterly basis for activity.

It might take some background research to locate a suitable bookkeeper due to the fact that, unlike accountants, they are not called for to hold a specialist accreditation. A strong endorsement from a relied on colleague or years of experience are very important aspects when hiring a bookkeeper. Are you still uncertain if you need to hire a person to help with your publications? Below are three instances that suggest it's time to employ an economic expert: If your taxes have actually come to be also complicated to take care of by yourself, with multiple earnings streams, international financial investments, several reductions or other considerations, it's time to hire an accountant.

6 Easy Facts About Tax Accountant In Vancouver, Bc Described

For small services, adept cash administration is an essential element of survival and growth, so it's a good idea to work with a monetary professional from the beginning. If you choose to go it alone, take into consideration beginning out with audit software application and also maintaining your books carefully as much as day. This way, should you require to employ a professional down the line, they will certainly have visibility right into the complete monetary background of your company.

Some source interviews were performed for a previous variation of this Full Article article.

Not known Details About Outsourced Cfo Services

When it comes to the ins and outs of taxes, bookkeeping and also financing, nonetheless, it never harms to have an experienced specialist to count on for guidance. A growing number of accounting professionals are also looking after points such as capital projections, invoicing as well as HR. Eventually, a lot of them are taking on CFO-like roles.When it came to using for Covid-19-related governmental financing, our 2020 State of Small Business Research discovered that 73% of small company proprietors with an accounting professional stated their accountant's advice was necessary in the application process. Accountants can also assist entrepreneur avoid expensive errors. A Clutch study of small company owners shows that greater than one-third of little services listing unforeseen costs as this contact form their leading economic difficulty, adhered to by the mixing of company and individual funds as well as the inability to obtain payments on schedule. Small company proprietors can anticipate their accountants to aid with: Selecting business framework that's right for you is important. It impacts how much you pay in tax obligations, the documents you need to file and your individual responsibility. If you're looking to transform to where is the movie the accountant being filmed a various business framework, it might cause tax consequences and various other problems.

Also business that are the exact same size and also market pay really various amounts for accountancy. These prices do not transform into cash, they are required for running your service.

Rumored Buzz on Vancouver Tax Accounting Company

The ordinary expense of accountancy services for tiny service differs for each distinct circumstance. The average month-to-month bookkeeping costs for a tiny organization will increase as you add a lot more solutions and also the jobs get more difficult.You can videotape deals and also process pay-roll making use of online software program. Software solutions come in all shapes and dimensions.

Not known Details About Tax Consultant Vancouver

If you're a new company owner, don't fail to remember to factor audit costs right into your spending plan. Management expenses and accountant charges aren't the only accounting expenditures.Your time is also useful and also need to be taken into consideration when looking at accountancy expenses. The time invested on bookkeeping tasks does not create earnings.

This is not intended as lawful guidance; to learn more, please click on this link..

Getting My Outsourced Cfo Services To Work

Report this wiki page